Incentivizing Affordable ADU Rentals

ADU Goal Supported: Making ADUs Affordable

Overview

This strategy provides financial or other incentives to property owners to build ADUs that will be rented at below market rents and/or for certain populations, such as local workers. By incentivizing ADUs rented at below-market rate, especially for specific populations, an ADU Supportive Jurisdiction can help ensure renters have increased affordable housing options near employment centers.

Benefits

- Encourages more rental housing options for residents at below-market rental rates.

- Focuses support on helping low- and moderate-income workers to remain in their communities.

- Helps low- and moderate-income renters with affordable housing options close to employment centers and community institutions.

- Provides a financial opportunity for homeowners that benefits the community.

- Reduces displacement for local workers such as school district and hospital staff.

- Helps jurisdictions meet local housing goals and demands by increasing the supply of affordable rental units.

- Supports tenant rights through monitoring and affordability compliance.

Image source: West Denver Renaissance Collaborative (WDRC)

- Evaluate program goals and identify targeted communities for support such as income-qualified, local workforce, or school district employees. This step could also include:

- Review past affordability requirements to see if they’ve discouraged homeowners from participating. (See pitfall below)

- Review your jurisdiction or region’s Housing Needs Assessment.

- Identifying potential partners, including local nonprofit organizations and financial institutions.

- Determine program mechanics. This includes:

- Eligibility requirements for tenants (income levels, employment details, etc.). Consider tying into an existing system for eligibility, such as Section 8.

- Types of incentives available (grants, low-interest and/or deferred loans, fee waivers/reductions, development incentives, etc.).

- Terms for ADU owners including commitment mechanism and length. For example, a deed restriction with a below market rate commitment for 5 years. Consider conducting a focus group or gathering input from ADU owners to understand their willingness to join a program with varying requirements.

- Terms for ADU owners who back out of the program, such as payback of grants or loans if they drop out early, and for tenants who no longer meet eligibility requirements. (See City of Grand Junction case study for an example of termination conditions for a similar program.)

- If not tying into an existing eligibility system (see above), monitoring of the program to ensure homeowners and tenants are meeting requirements over time. You may need to partner with an outside agency or organization to help with this, since jurisdictions may not be set up to conduct this monitoring.

- Identify the cost and potential sources of funding for the program. Estimate the financial benefit for a typical ADU project as well as the number of applicants you think might utilize the program in a typical year. Secure support from leadership for implementing the program.

- Consider implementing the program for a limited period of time to start. Offering a time-limited financial incentive functions like a sale, encouraging applications, and can be extended for a longer time if desired. This can also help with testing ADU owner interest and estimating the financial commitment to the program during an initial pilot period, then refining and continuing the program based on experience and feedback.

- Ensure homeowners are aware of the program and its benefits. Utilize existing communication channels to reach ADU homeowners such as: city newsletters, utility bill inserts, and social media; local media; targeted mailings to known ADU owners and builders, and/or presentations to groups like local non-profit organizations. Identify existing affordable housing partners, whether internal programs or external organizations, to connect participating ADU owners with tenants.

- Establish a monitoring program for ongoing tracking and compliance. If a jurisdiction currently has a department or Housing Authority monitoring Section 8 or other housing on an annual basis, consider utilizing existing infrastructure and processes.

Insufficient number of affordable ADUs available to keep up with demand.

- Consider improving the desirability to participate by expanding the type and amount of incentives homeowners can receive, and reduce the program's complications to encourage more ADU development.

Terms can seem intimidating to homeowners and dissuade participation.

- Requiring homeowners to commit to renting their ADU affordably for long timelines or requiring them to commit via a deed restriction may be intimidating and reduce participation. Keep the terms clear, achievable, and realistic.

- Allow pathways for when a tenant’s circumstances change. For instance, what if their income rises or their employment details change? How can they retain their living situation and avoid the homeowner needing to find a new tenant?

Monitoring can be complicated and require investment, and it can be difficult to ensure long-term affordability.

- Utilize existing affordable housing compliance infrastructure, such as Section 8.

- Create new systems that are linked to homeowner reporting protocols to ensure that rents remain affordable.

Limited awareness can result in low participation from renters that might be interested.

- Strengthen outreach by forming partnerships with community-based organizations and nonprofits, tenants-rights groups, housing advocates, supportive services and government agencies that have a direct connection to low and moderate income households.

- Durango: See the Durango case study for more details.

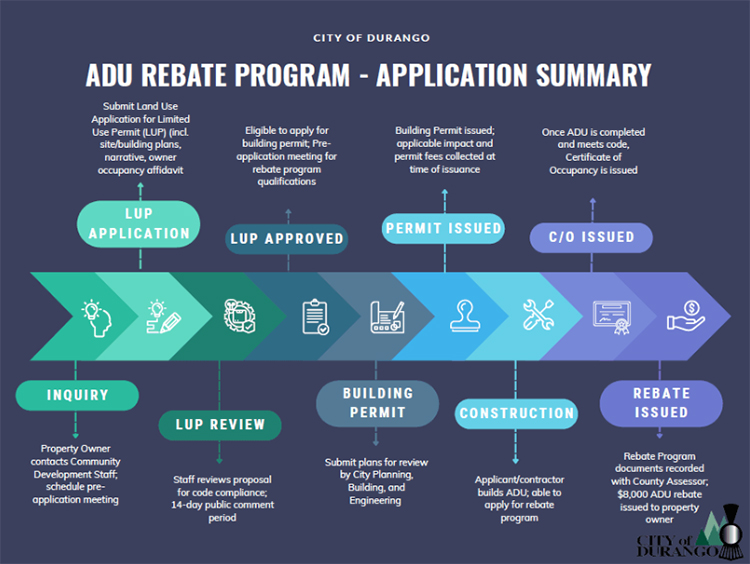

In 2023, the City created a program incentivizing the construction of ADUs. The ADUs for Locals Program offers financial incentives to property owners who construct an ADU and commit to renting it to a member of the local workforce. The rebate is a flat dollar amount of $8,000 for newly constructed or legalized units. Owners must rent their ADU to a local who works at least 32 hours a week for a business or organization located in La Plata County. Tenants must reside in the unit as their primary residence. - Eagle County: The Eagle County Housing and Development Authority’s (ECHDA) Aid for ADU program began in May 2022 to support the creation of new ADUs. This program provides existing property owners with a low cost loan for the construction or conversion of existing space to an ADU on the owner’s property, where permitted. The intent of the program is to create new housing units for the year-round renter at attainable rental rates in Eagle County. Property owners may apply for up to $100,000 towards the construction of an ADU on their property with a 2% interest rate. No payments or interest are due for the first three years of the term. Renters must have income of 100% AMI or less.

- Gunnison County: The Housing Matters Program, operated by the Gunnison Valley Regional Housing Authority (GVRHA) encourages STR owners to convert their property into long term rentals (LTRs) for local employees. Property owners must agree to a minimum of a 1-year lease term and offer rents affordable to local wages based on household size. Landlord benefits include having a lease agreement with the local agency (GVRHA) as opposed to individual tenants, guaranteed rental income, lower property management fees (compared to STR management companies), and tenant screening/recruitment (done by GVRHA).

- Boulder: See the Boulder case study for more details.

The Affordable ADU Program allows homeowners to build a larger ADU if they commit to rents that do not exceed 75 percent of the area median income. This means up to 1,000 square feet for a detached ADU or up to 1,200 square feet or 2/3 the size of the principal home, whichever is less, for an attached ADU. Each year the city provides a table of affordable ADU maximum rents. Once approved for an affordable ADU, a Declaration of Use must be recorded with the Boulder County Clerk and Recorded, which includes a sworn certification the unit will meet the affordability requirement. It must be signed by the property owner and submitted with the building permit application. - Summit County: See the Summit County case study for more details.

The ADU Assistance Program reimburses up to 25% of construction costs to convert non-compliant ADUs into compliant ADUs, requiring recipients to agree to workforce housing covenants and rental caps at 110% AMI in exchange for the funding.

- Allowing ADUs in Zones Other Than Single-Family: Multi-family property owners may be interested in incentives for ADUs rented to local workers, income-eligible households, and/or participants in existing affordable housing programs. This may also help add ADUs on multi-family properties that already have affordable housing.

- Waiving or Reducing ADU-related fees for Low- and Moderate-Income Households

See this strategy for details on fee waiver/reduction mechanisms that could also be used as incentives for affordably rented ADUs. - Waiving or Reducing ADU-Related Fees for All Applicants

This strategy lowers the costs of building an ADU by reducing or eliminating fees charged by local agencies—such as fee waivers or reductions—for all households. This opportunity differs from Waiving or Reducing ADU-related fees for Low- and Moderate-Income Households by opening it to all households, regardless of income. The goal here is a subtle shift from specifically making ADU development more affordable for limited income households to increasing ADU development across the board. - Providing Support for Homeowners Becoming Landlords: While all homeowners building ADUs could benefit from resources on becoming a landlord, participants in this program may be particularly motivated to build an ADU for altruistic or community-oriented reasons and possibly less likely to know much about becoming a landlord. Resources on finding a tenant, maintaining a unit, rental laws, and more will be helpful.

- Partnering with Tenant Matching Organizations: Tenant matching organizations may be well-suited to helping ADU owners find tenants that are eligible for this program, especially seniors.

- Supporting the Development of an ADU Nonprofit: An ADU nonprofit can help with marketing of this program and with supporting homeowners in utilizing it.

- Identifying Strategic Outreach Priorities: Identifying landlords of single-family properties as a particular target for outreach and resources pairs nicely with this incentive program. Property management companies with single-family properties may be interested in multiple ADU developments at a time, using this incentive multiple times (if allowed).

- Regulating the Use of ADUs for Short-Term Rentals: Homeowners unable to use their ADU as a short-term rental may be more likely to consider participation in this program. Conversely, allowing potentially quite lucrative short-term rentals of ADUs may limit participation in this program.

- Partnering with Lenders to Provide Loans and Financing Opportunities: Committing to renting their unit at a potentially lower rate may change the long-term financial calculations for an ADU project, and homeowners interested in participating in this strategy may have greater need for creative financing solutions (ADU loan programs, grants, etc.).

Strategy Profiles

Accessory Dwelling Unit (ADU) Toolkit

We're Here to Help!

Do you have questions about the new laws and impacts to your jurisdiction? Check out our FAQ page, visit our main State Land Use and Housing Legislation page to learn about all the laws, or get one-on-one support below: