Severance And Federal Mineral Lease Direct Distribution

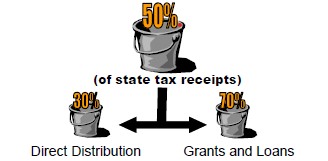

DOLA portion of State Severance Tax

Allocated to County Pools based on statewide share of the following factors:

| Factor | Percentages* |

|---|---|

| Colorado Employee Residence Reports (CERR) | 40% |

| Mining and Well Permits | 30% |

| Mineral Production | 30% |

*No single factor of the three listed above shall be less than 30%, with the remaining 10% allocated among the three factors at the discretion of the executive director, based on recommendation from the Energy and Mineral Impact Advisory Committee.

The Sub County Pools are allocated based on the countywide share of the following factors:

| Factor | Percentages** |

|---|---|

| Colorado Employee Residence Reports (CERR) | 33% |

| Population | 34% |

| Road Miles | 33% |

**Percentages may be based on recommendation from the Energy and Mineral Impact Advisory Committee or memorandum of understanding between county and all of its municipalities, with final determination by the executive director.

Annual distribution of revenues to Counties and Municipalities by August 31st.

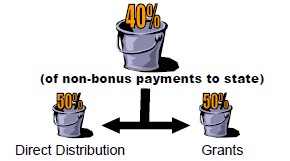

DOLA portion of Federal Mineral Lease

Allocated to County Pools based on statewide share of the following factors:

| Factor | Percentages* |

|---|---|

| Colorado Employee Residence Reports (CERR) | 35% |

| Federal Mineral Lease Revenue Generated | 65% |

* CERRs (35% maximum) and the remaining percent from generated federal mineral lease revenue to be determined by the executive director, based on

recommendation from the Energy and Mineral Impact Advisory Committee.

The Sub County Pools are allocated based on the countywide share of the following factors:

| Factor | Percentages** |

|---|---|

| Colorado Employee Residence Reports (CERR) | 33% |

| Population | 34% |

| Road Miles | 33% |

**Percentages may be based on recommendation from the Energy and Mineral Impact Advisory Committee or memorandum of understanding between county and all of its municipalities, with final determination by the executive director.

Annual distribution of revenues to Counties, Federal Mineral Lease Districts and Municipalities by August 31st.

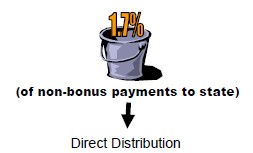

Separate Distribution of Federal Mineral Lease to School Districts

Allocated to County Pools based on statewide share of the following factors:

| Factor | Percentages* |

|---|---|

| Colorado Employee Residence Reports (CERR) | 35% |

| Federal Mineral Lease| Revenue Generated | 65% |

*County Pool percentages to school districts will be identical to those used for County Pool under “DOLA Portion of Federal Mineral Lease”.

The Sub County Pools are allocated based on the countywide share of the following factor:

| Factor | Percentages |

|---|---|

| Pupil Counts | 100% |

Annual distribution of revenues to School Districts by August 31st.